With the President-Elect locked in for 2025, many expect things to change. In my view, President-Elect Trump essentially ran on a platform of “Screw those guys; what did they ever do for you? Just elect me and I’ll fix it,” where “it” was left perfectly undefined so that all Americans could fill in with their own hopium.

We’re sure to see what “it” really meant soon; many are hoping it means a turnaround in their grocery bill and in their general cost of living. Is that really something that’s possible, regardless of administration? Simply put: absolutely not.

Monthly vs. Cumulative Inflation

There’s no question that the average trip to the grocery store is much more expensive than it was before COVID decimated our society. We’ve all seen the monthly (or annual) CPI numbers on the news and the interest rates on high-yield savings accounts fluctuate since the pandemic, peaking at almost 9% at one point in late 2022.

Whether you want to attribute this to supply chain setbacks, the Fed’s printer injecting \$4T into the money supply, geopolitics, or simple corporate greed, it doesn’t change the fact that we have a cumulative inflation rate of around 22% since 2020.1 People are easily deceived since they only see monthly or yearly inflation statistics without thinking about how those percentages accumulate into a behemoth sucking away your net worth. Let’s put that number into perspective:

- A \$100 bill today would only buy you \$82 worth of goods in 2020.2 That means that even though you’re spending that \$100 at the grocery store today, you’re only getting \$82 worth of actual “stuff” by 2020 metrics. Put another way, you would need \$122 today to buy the same set of groceries you paid \$100 for in 2020.

- Extrapolating that, a \$100,000 annual salary in 2024 is the same thing as a \$82,000 salary was in 2020.3 That means unless you got raises totaling to 22% over the last 4 years, you’re making less money than you did in 2020. Well, you’re making more dollars, but the dollars don’t go as far.

- If you invested in an index fund—suppose one tracking the entire market like VTI—in 2020, you would be up 55% on paper today,4 but inflation cuts into that gain almost in half to only (well, “only”) 23% over 4 years, which is a decent, but not strong, return… Ahhhh who am I kidding; that’s still a crazy return. Moral of the story: don’t let spare money sit around.

Suffice to say, the distance each of our dollar’s can go has decreased significantly.

Inflation Trends

Today, the misguided hope for the new administration as a force for curbing price increases relies on a fundamental misunderstanding about the way economics work: prices don’t go down. Inflation is (essentially) always a positive percentage, meaning prices always increase. Negative inflation (or deflation), is not considered a good thing economically.

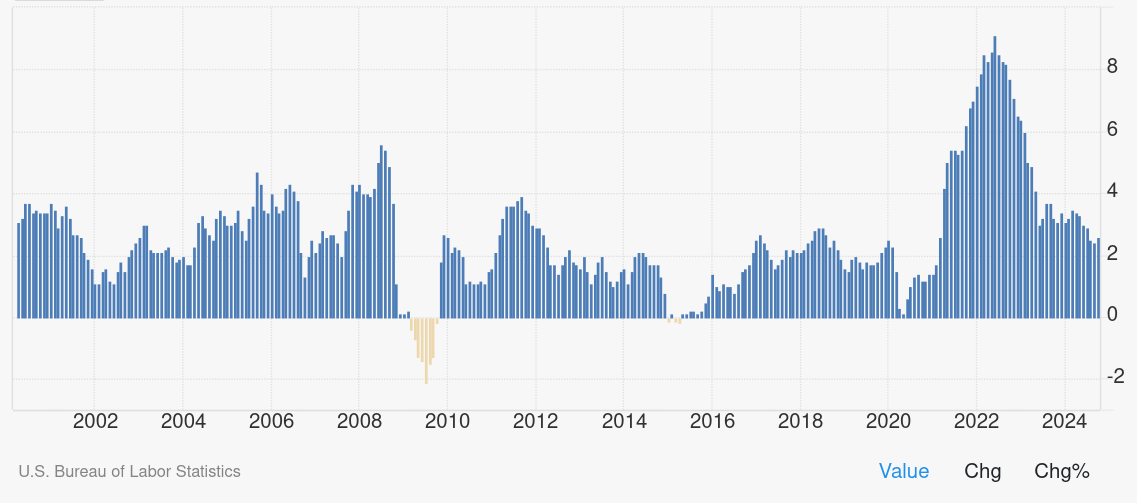

Look at the consumer price index (a.k.a. the fancy tracker for “inflation,” which can be manipulated as needed to not let the numbers look as bad as reality) for this millennia:

Consumer Price Index from 2000 — Present

The last time prices actually went down was in 2009, and there was a significant concern that deflation would spiral out of control. That means that prices have only gone up since 2010.

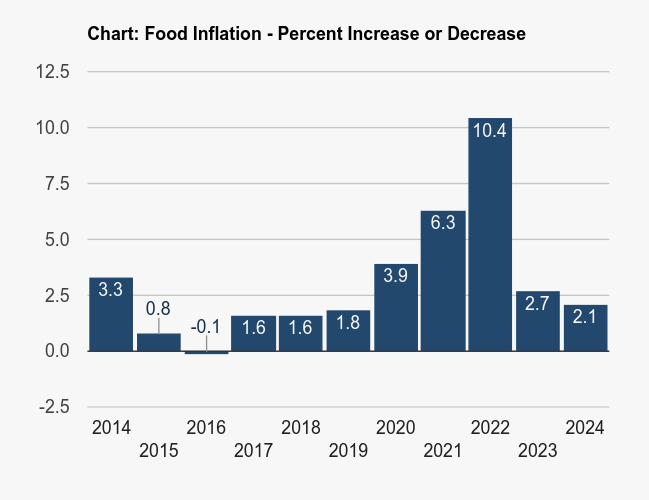

Now yes, CPI is technically the average of a bucket of categories. Each of these has their own price graph, but if you look at the 20 year plot published by the U.S. Bureau of Labor Statistics themselves and plot everything besides energy-related categories, you can see that things still rarely dip into the negative. When they do, it’s very short-lived, and it certainly doesn’t decrease prices on a scale that’s noticeable to a consumer over time. Here’s the plot for food:

Food Inflation, last decade

And inflation isn’t the only factor that can cause price fluctuations.

Tariffs: Perception is Reality

President-Elect Trump has promised a 25% tariff on goods exported by Mexico and Canada.5 Trump claims the tariffed nations will pay the price of this tariff, whereas left wingers and economists say the American people will pay for them because corporations will pass the buck in price.

Only time will tell the truth, but one convenient thing of note about the whole fiasco to me is that I don’t remember hearing a single peep about tariffs’ relationship to price increases when Biden increased tariffs to 25% against China last May,

President Biden is directing his Trade Representative to increase tariffs under Section 301 of the Trade Act of 1974 on $18 billion of imports from China to protect American workers and businesses.

— The White House, 05/14/2024

The list of items (already) being tariffed is expansive. These are a continuation of the same tariffs Trump enacted against China on his first lap around the White House. So from a logical standpoint, the jury should still be out. Despite that, though, I think the unfortunate reality of our pending future is best summed up by some shitposting redditor today:

Psychology is everything in economics. As I’ve noted in another post, the perception of value pretty much means everything in terms of whether or not a price point will be accepted. Given that everyone is reeling over Trump’s announcements and expecting price increaases, it creates a self-fulfilling prophecy: of course corporations are going to increase prices when the general public literally expects them to. They don’t have to be affected by the tariffs at all; they could be in an unrelated or US-only industry, and yet they can certainly get away with a price increase because the collective unconscious of our society has essentially manifested reality.

The exact same thing just happened during (and after) COVID and we collectively just let ’em get away with it.

Conclusion? GG.

One thing is systematically clear, which I think a lot of people are either oblivious or in denial about:

Today's prices are here to stay.

To use an borderline traumatic term: they’re the “new normal.” Forever gone are the days of 2/$1 candy bars, and if they ever come it’ll be for the mini variant not the full size.

If the current administration had a spine and curbed price increases in crucial categories to check corporate price-fixing at least a little bit so we didn’t see that 10% spike in 2022, we could start from a better baseline. But, as Biden whispered, it grows the economy… just… the part of the economy that doesn’t (positively) affect real working class people.

The only way for us to resolve the issue is for wages to exceed the pace of inflation. Of course, I doubt we’ll see anyone retroactively get 20% raises, nor any meaningful raises going forward if the trends of the past four years continue… Good luck everyone.

-

https://www.in2013dollars.com/us/inflation/2020?amount=81.99 ↩︎

-

https://www.in2013dollars.com/us/inflation/2024?endYear=2020&amount=100000 ↩︎

-

I calculate 2020 as being 4 years from the writing of this post, so November 2020. This is because the site linked above this footnote doesn’t make it clear when the inflation for a year is snapshotted: is it an average over the year, is it the middle, end, start, etc.? Thus, it’s a little hard to make consistent arguments about the relative value fluctuation over time. So, I just chose a date on the VTI graph approximately matching today’s date. ↩︎